Featured

Table of Contents

At The Annuity Expert, we understand the complexities and emotional stress and anxiety of planning for retirement. You desire to ensure financial safety and security without unnecessary threats. We have actually been leading clients for 15 years as an insurance coverage firm, annuity broker, and retirement organizer. We mean discovering the very best remedies at the lowest prices, guaranteeing you get the most worth for your financial investments.

Whether you are risk-averse or seeking higher returns, we have the proficiency to guide you through the subtleties of each annuity kind. We recognize the anxiety that features economic unpredictability and are right here to offer quality and self-confidence in your investment decisions. Begin with a totally free consultation where we assess your financial objectives, danger resistance, and retired life demands.

Shawn is the founder of The Annuity Specialist, an independent on-line insurance company servicing consumers throughout the USA. With this platform, he and his team goal to remove the guesswork in retired life preparation by aiding people locate the best insurance policy protection at the most competitive rates. Scroll to Top.

Exploring the Basics of Retirement Options Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Features of Fixed Income Annuity Vs Variable Growth Annuity Why Variable Vs Fixed Annuities Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Fixed Income Annuity Vs Variable Growth Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing Fixed Vs Variable Annuity Pros And Cons Financial Planning Simplified: Understanding Fixed Index Annuity Vs Variable Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

This costs can either be paid as one round figure or dispersed over a duration of time. The cash you add is spent and afterwards eligible for regular withdrawals after a deferral duration, depending upon which annuity you select. All annuities are tax-deferred, so as the value of your agreement grows, you will not pay taxes till you get earnings settlements or make a withdrawal.

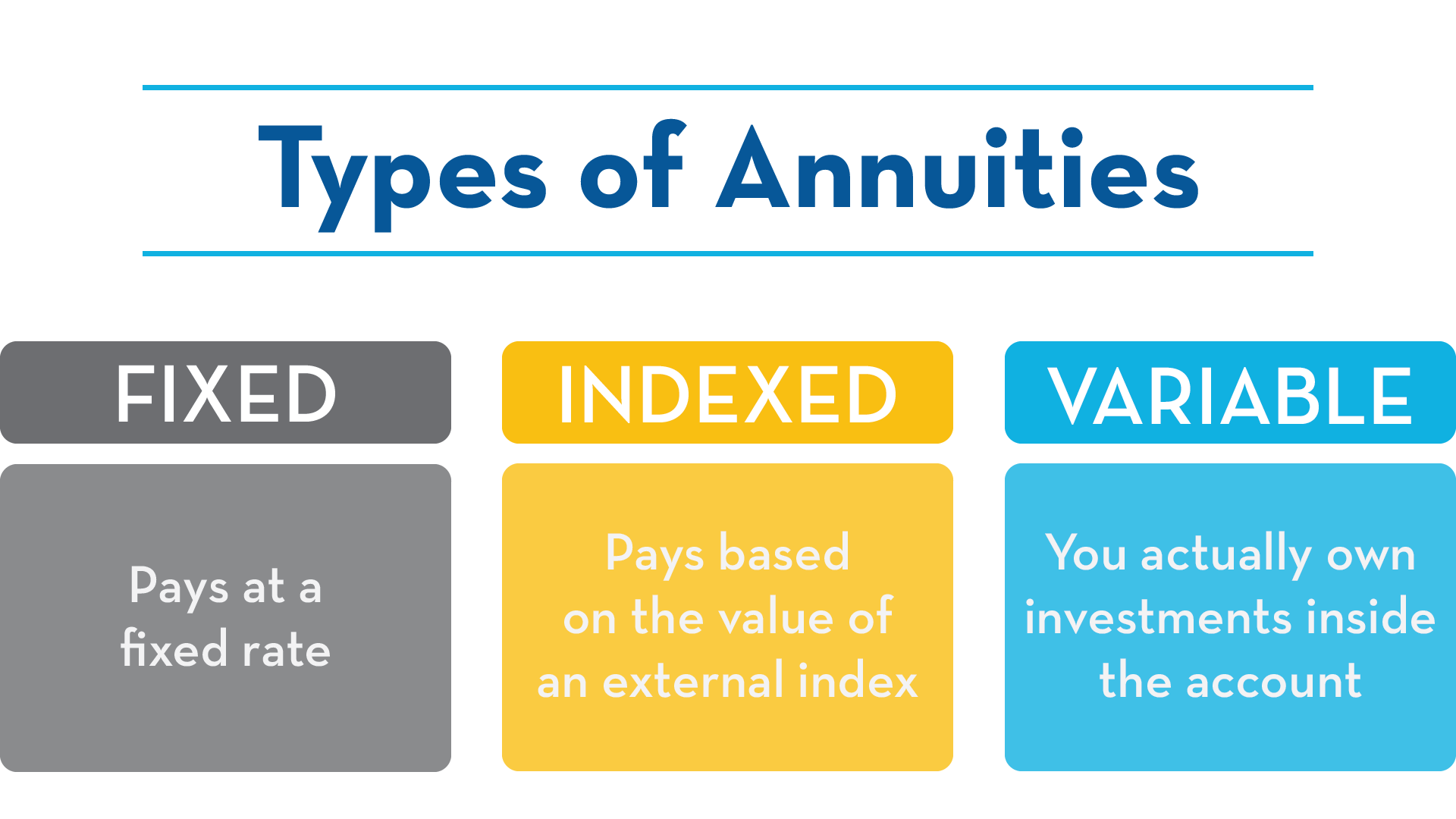

Despite which selection you make, the cash will be rearranged throughout your retirement, or over the duration of a selected amount of time. Whether a round figure settlement or several premium payments, insurance provider can provide an annuity with a set rate of interest that will be attributed to you over time, according to your agreement, referred to as a set price annuity.

Highlighting What Is Variable Annuity Vs Fixed Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Fixed Interest Annuity Vs Variable Investment Annuity Is Worth Considering Fixed Indexed Annuity Vs Market-variable Annuity: Explained in Detail Key Differences Between Fixed Income Annuity Vs Variable Growth Annuity Understanding the Risks of Fixed Index Annuity Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Choosing Choosing Between Fixed Annuity And Variable Annuity Financial Planning Simplified: Understanding Variable Vs Fixed Annuities A Beginner’s Guide to Annuity Fixed Vs Variable A Closer Look at Variable Annuities Vs Fixed Annuities

As the worth of your fixed rate annuity grows, you can proceed to live your life the way you have always had actually prepared. Be certain to consult with your economic expert to determine what kind of set price annuity is right for you.

This provides you with ensured revenue earlier instead of later. You have alternatives. For some the prompt option is an essential option, yet there's some versatility right here too. While it may be utilized instantly, you can additionally postpone it for up to one year. And, if you defer, the only part of your annuity considered taxable earnings will be where you have accumulated interest.

A deferred annuity enables you to make a lump amount payment or several payments over time to your insurance coverage firm to supply earnings after a collection duration. This duration permits for the rate of interest on your annuity to grow tax-free before you can gather repayments. Deferred annuities are usually held for around twenty years before being eligible to get repayments.

Exploring the Basics of Retirement Options A Comprehensive Guide to Investment Choices What Is Fixed Vs Variable Annuity Pros Cons? Features of Smart Investment Choices Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Annuities Fixed Vs Variable A Beginner’s Guide to What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at Fixed Vs Variable Annuity

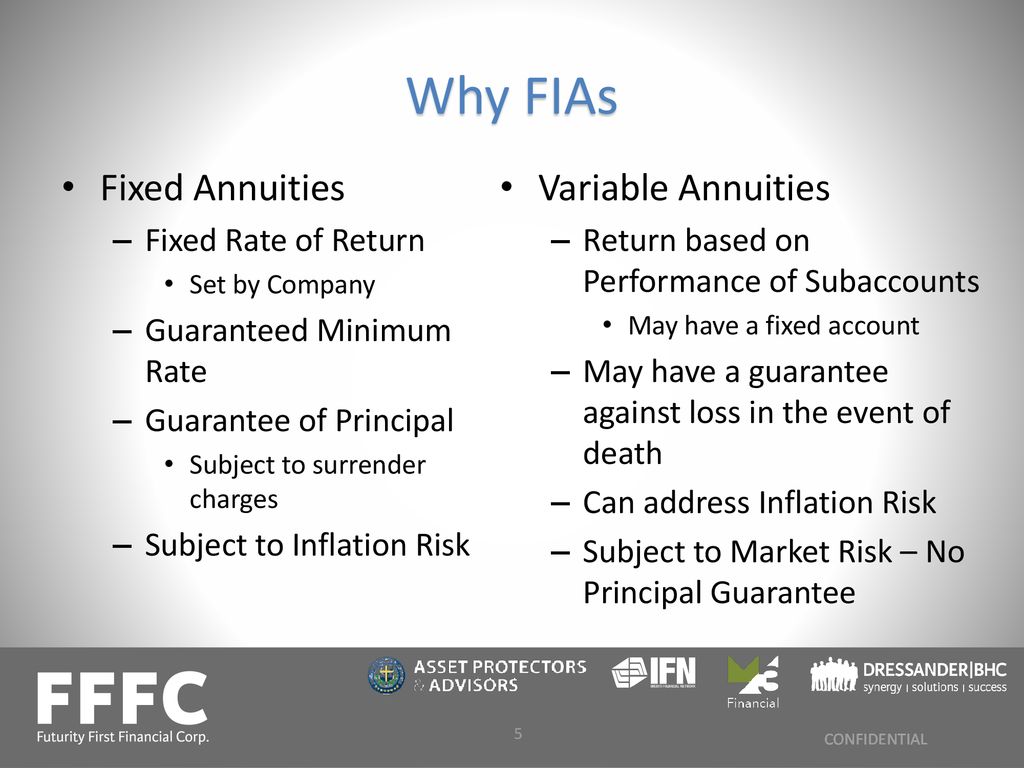

Because the interest price depends on the efficiency of the index, your money has the opportunity to expand at a various rate than a fixed-rate annuity. With this annuity strategy, the rates of interest will never ever be much less than absolutely no which means a down market will not have a significant adverse effect on your income.

Just like all financial investments, there is capacity for threats with a variable rate annuity.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Index Annuity Vs Variable A

Understanding Financial Strategies Everything You Need to Know About Fixed Vs Variable Annuities Defining the Right Financial Strategy Features of Fixed Income Annuity Vs Variable Growth Annuity Why C

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Advantages and Disadvantages of What Is Variable Annuity Vs Fixed Annuity Why Fi

More

Latest Posts